Acquisition project | Sekel Tech

Understand 🧠

Product

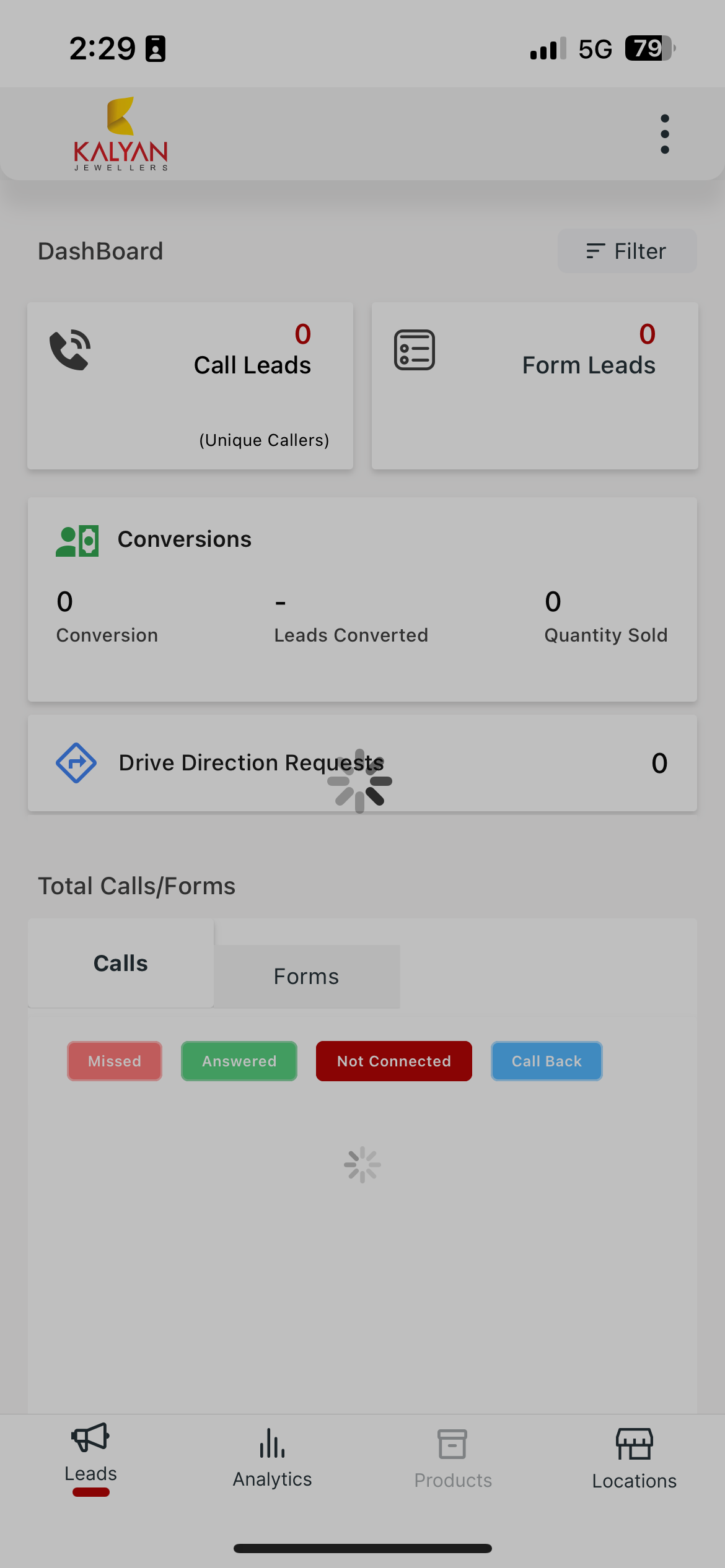

Sekel Tech is a hyperlocal discovery and omni-commerce platform. It works with multi-store retail brands. Its key offering is a web platform to manage location listings across GMB and Bing. It creates microsites with the location information and product information along with the store locator. Enables adding IVR to the stores and gathering user call data. It provides an LMS for the brands to view their call, forms, and WhatsApp leads. It also includes search, location, and lead analytics. Along with this, it has also integrated to run campaigns ( SMS, WhatsApp, Email, Google, Meta ).

Product Screenshots

Below are the screenshots of the web platform and mobile platform. The web is for the brand admins and the mobile is for store admins to manage their leads.

Organic search

Searched location marketing and the below screenshot is for that, because of this some of the inquiries tend to be towards a digital marketing agency and advertising agency and not a SAAS platform.

Reviews

Sekel tech doesn't have reviews and ratings in Twitter, Reddit, Capterra, and G2. There is 0 engagement on YouTube and social media. Though there is presence, it is a weak with minimum engagement.

0 reviews on Capterra

Posts on Reddit but no engagement or content loops initiated

Twitter searches

Minimal engagement on Youtube

User

Macro Objective | Details | User - 1 ( Enterprise Retail Marketeer ) | User - 2 ( Enterprise Retail Marketeer ) | User - 3 ( Store Owner SME ) | User - 4 ( Sales Member of SME ) | User - 5 ( Sales Team of SME ) | User - 6 ( Digital Marketing Agency Members ) |

|---|---|---|---|---|---|---|---|

Basic Info | Age | 18-35 | 35-45 | 48 | 18-35 | 18-35 | 20-30 |

City | Bangalore | Pune | Pune | Delhi | Sitamadi Bihar | Pune | |

Education level | Graduate, BE in Electronics | Post Graduate | Graduate | Graduate | Post Graduate | Graduate | |

Married | Yes | Yes | Yes | Yes | Married | No | |

Kids | No | Yes | 2 kids. Daughter in Clinical Psychology Chicago | Yes | Kids 2 | No | |

Job Profile | Lead Omni Channel | Retail Marketer | Owner of the Shop | Shop Owner | ISP | Digital Marketing Agency | |

Apps On Mobile | Linkedin, Instagram, X, Whatsapp | Facebook, LinkedIn, Whatsapp | Whatsapp, Facebook ( equipement ), Youtube | Whatsapp, Facebook, Gmail. | Instagram, Whatsapp, Linkedin, Money Contol | ||

Content Consumption | Anything and everything | News and Entertainment | Meditation, Yoga, Speeches. Mira Desai | Reading and Listening to music | Sports | Entertainment, Marketing education, news, politics, launch of brands, AI-related, Stock market. | |

Hobbies | No Hobbies | Badminton and Running | Travel, Reading, Cricket, Football. Lawn Tennis | No Content absolutely | No hobbies | Reading, Dancing, Cooking, Traveling, Cafes. | |

Responsibilities | Enabling the visibility of retailers | Business Development, Lead Generation, Support Retailers | Full responsibility of the shop. | Running the shop and managing sales | Quick actions and operations of the store | Brand Strategy, SEO, Email marketing, Sales, Template Design. | |

Acquisition | Evaluation of Sekel | Visibility was the problem. The customer doesn't know where the products are. | Ability to handle the scale of retailers and ROI | Features to add Software to be connected to Tally. | Searches on google | No particular process. | Based on the requirement or gap identified for thier clients, if they have seen thier brands local stores are missing SEO. Search Term: Digital Marketing company for Local Store Management |

Stakeholders Involved | Global Marketing team and regional team. | Internal, Marketing Funciton, IT Team, Purchase Team, Sales Team. | All decisions are taken by himself. | All by themselves | Sales Team, Seniors, SM, ZSM, TL. | Team Lead, Directors final Decision. | |

Where to get info | Global team, Regional. Forums, Nascom, Conferences, IEM, meetings, Meets. Country discovers before. | Google and LinkedIn. WOM. Tech and Marketing Partners | Getting information from some of the dealers | Google | Meetings in Zoom. The sales team indicates to use of the app. Guidelines set by the team | Google, Freelancer, Upwork, Behance | |

Major Challenge | Discovery is unable to connect to conversions or sales. | No Ad campaigns. No Retargeting of the leads Turnaround time of integrations | None | Before there were issues of logging. | Area and location-wise leads are not correct. Most leads are not aware of the request such as printer. Purchases are way less. Out of 10 leads, 7 are services, prices, and not interested. Mostly from far off not in the same area. | NA | |

Important Criteria | Ability to convert to actual sale numbers | Stability of the platform. | Ability to track inventory via billing through the app. set minimum inventory per brand. and reminders of when the minimum reach is. | Able to get leads from nearby locations instead of far-off locations | Mostly need local areas who are qualified with knowledge of the products. | What are they providing, Services and, what all will be received | |

Why Sekel | Solves the visibility of retailers and products. Not the one who chose but the boss. | Sekel provides SEO, Listings and IVR. One single vendor vs multiple vendors | Getting all the call information. Recordings. And Proof of conversations | The brand had given them the mandate to install to get leads. | Has little knowledge. | Communication and Offer | |

Onboarding | First impression | New to the platform. Didn't understand why only a few stores were onboarded | Onboarding good. Long time for agreement analysis. Transition Smooth from the previous vendor. But high attrition in the first few months at Sekel | None as of yet, as got exposed recently | Starting, app issues were huge. Calls are not product-related. Outside areas leads were coming. Nearby. | Didnt know much about the app. Only in meetings slowly. No issue using the application. Leads quality and quantity are a little problematic | Partner program |

Help Needed | Yes, needed from multiple POCs to achieve good numbers | One demo and everything was clear. No need for further demos. | Don't require any material helpful. | Calls and training. Sessions are taken by the sales team to train them. trainers used to conduct. TLs are used to connect | Not required | ||

KPI to track | The key KPI is sales, since no sales, Impressions, calls, and forms | Leads, Conversions, and Missed Calls | Number of leads or calls received per day. | Customer and relevant customers needed and that key. | Before the leads they got from other application, the customers knew about the products. | ||

Engagement | Major issues | Dashboard numbers keep changing. Inconsistent | Store information is incorrect. Expects the team to inform earlier than the field team. | Calls during off hours to the store managers should not connect and they should receive a notification the next morning to follow up | No major issues. Same calls twice. 25-30 initially. Now 2,3 days only 1 call. | No Issue | |

Top 3 favorite functionalities? | Dashboard, Ad campaigns and e-commerce | Dashboard access. | None as of yet since used the app only once during training | App no issue. | No favorites as of now | ||

Why continue | Visibility and impact on the ecosystem | Overall performance is satisfactory. Dealer's performance and growth. Working stable. | - | Direct calling the leads is the favorite | Mainly to reach out to the leads to sell products | ||

Retention | Why not full utilization | Need meaningful data to show the PL team | Not aware of the features and products. | - | | | |

Marketing Spend allocation? | Confidential | SEO, BTL activations, Trainings to channel partners, Branding. | - | Marketing spending is done company not by the store. GMB is not sure. The company sends the poster to an update. Content, team from the brand comes branding. Whenever a new launch. No issue. to spend on marketing. | No Spend | ||

Is anything unique | Execution to achieve onboarding of retailers and discovery numbers | Complete product, SEO, GMB listing and IVR solutions. Sekel is not far far ahead from the competetion. | - | | Nothing special. Lead closing, or customer status updating is easier and hence unique in the app |

The research was conducted between, Retail Marketeers, Store Owners, Sales Partners and Digital marketing Agencies.

Prioritization of the ICP.

Prioritization | Retail Marketing Manager | Store Owner | Sales Partners | Digital Marketing Agency |

|---|---|---|---|---|

Adoption Curve | Medium | High | Low | High |

Frequency of Use | High | High | Low | Low |

Appetite to Pay | High | High | Low | Low |

TAM | High | High | Low | Low |

Distribution Potential | Medium | Medium | Low | High |

Below are the 2 ICPs that will be focused on now. Where the Retail Marketing Manager is representing a B2B.

Characteristics | Retail Marketing Manager | Store Owners |

|---|---|---|

Age | 30-55 | 30-55 |

Gender | Male/Female | Male |

Location | Tier 1 | Tier 1 / Tier 2 |

Salary | 20-30 LPA | 15-30 LPA |

Apps | LinkedIn, Facebook, Whatsapp | Whatsapp, Facebook, Youtube |

Married | Yes | Yes |

Kids | Yes | Yes |

Watch | Entertainment, News, and everything | Mental health and wellbeing |

Size of the company | 1000+ | 20+ |

GMV / Funding | 1500+ Cr companies | Bootstrapped |

Industry | Automobile, Electronics, Home Improvements | Automobile, Electronics, Home improvements |

Profile | Marketers | Entrepreneurs |

Growing / Saturated | Growing | Growing |

Org Structure | Multiple BUIs with Global, Region, and Hierarchical | Smaller + Hierarchial |

Market

Competitors like Shopify, BigCommerce, Salesforce, and SAP dominate the omni-commerce space. However, when it comes to hyperlocal discovery, Sekel stands out with unique features tailored for this niche.

| Synup | Single Interface | Partoo | Sekel tech | BrighLocal |

|---|---|---|---|---|---|

Size | 201-500 | 201-500 | 201-500 | 51-200 | 51-200 |

Mission Statement | A local listings & review management platform, which is an integrated marketing solution for multi-location brands. | Hyperlocal Marketing & Commerce Platform for Businesses with Physical Locations. | Stay Close to your Customer | Mastering Hyperlocal Digital Success: Harnessing the Power of Data, Discovery, and Demand Platforms | Take the lead in local search |

Pricing | $34, Free Trial | Not Displayed, but usually 1.5L/month | Not available | $75 | $39 |

Top Features | Listing Reviews Social Media Campaigns Pages | Presence Management Engagement Management Reputation Management Review Management Transaction Management Call Leads | Presence Management Review Management Review Booster Messages Store Locator | Presence Management Review Management Product Management Campaign Management Lead Management | Dashboard Competitor Analysis Location Management Reporting Review Management |

Strengths |

|

|

|

|

|

Weakness |

|

|

|

|

|

Summary: Sekel competes with major international players known for their extensive features. In India, it also faces tough competition from aggressive, sales-led, and operation-heavy rivals.

TLDR; Sekel Tech is a platform for hyperlocal discovery and Omni commerce of a store in its early scaling stage with core users being the multi-location brand's retail marketing team and the store owners. Its competition is tough both locally and globally and has a premium price point compared to its competitors

Core Value Proposition ➕

TAM SAM SOM

The total TAM for the Hyperlocal Market is 6.1 trillion Dollars as per this source. This includes the entire commerce and not just the Hyperlocal discovery.

Calculation for Large Enterprises

Picking companies that have stores in Bangalore by using the GeoIq tool to find out the number of brands present and similar brands that would be present across the country. The number is ~ 400 retail brands. Which is one country, for similar brands in other GeO the cost would be multiplied. The total market in APAC, EU, and the Americas would be 3x

Totall TAM = 400 * 3.6cr * 3 ( ARPU ) = 4320 CR

Of this SAM would be catering to just the Indian market = 1440 CR

SOM keeping in the price point and available competition, therefore, a market share ~ 10% ( Since SI has more than 100, and Sekel has only 10 brands as of yet ). = 1440 * 0.1 = 144 CR

Calculation for Small and Medium Enterprises

Total Businesses on Just Dial | TAM ( Total * 0.9 * 0.4 * 3000 ) | SAM ( TAM * 0.085 ) | SOM |

43,000,000.00 | 46,440,000,000.00 | 3,947,400,000.00 | 394,740,000.00 |

| 90% of Active business in 40% Urban Areas * 3000 per location / month | 8.5% of Auto and Home Improvement Store | 10% of market share Capture |

Therefore total SOM = 144 + ~(40 *12) = 624 Cr

Core Value Proposition for Store Owners

For store owners seeking to boost foot traffic and generate more leads, our location marketing app is your ideal solution. It enhances your local visibility across digital search and social platforms, guaranteeing a minimum 300% increase in traffic, inquiries, and sales.

Core Value Proposition for Brands

For brands aiming to stay competitive and achieve high-performance growth, Sekel’s hyperlocal discovery and omni-commerce platform is your key to success. Our stable, scalable solution provides real-time actionable insights, helping you capture local customers and drive up the revenue by 150% at least

TLDR; The Total TAM for Large enterprises is around ~4K CR and SME is around ~45K CR, whereas the SAM is 624 CR.

Right to win is the superior product available with complete set of features for a SME to get discovered and run omni commerce with little effort. Stable, Scalable and Simplifed platform. Proven results and great word of mouth.

Acquisition 🧲

Since the stage of the company is in early scaling, therefore experiments across all the channels is something that needs to be done.

TLDR: Organic SEO, LinkedIn ads, and Partner program were the experiments chosen which are minimum effort, scalable, stable CAC.

Organic 🍀

Search

Sekels organic strategy is pretty good, Sekel gets a good amount of leads from the website, around 63 leads per month across large and small enterprises.

Therefore the organic search intent would need very little updates based on the keywords search below.

Type of Search | Search Query | Search Volume / Month | Effort To Rank | Time to get an Outcome | Search Result to Click Rate | Visitor to Trial Rate | Potential Monthly Signups |

| Use Case Search | increase foot traffic | 110 | Low | Short | 20% | 7% | 1.54 |

local store promotions | 0 | Low | Short | 0% | 0% | 0 | |

Hyperlocal marketing | 720 | High | Long | 15% | 5% | 5.4 | |

in-store engagement | 10 | Low | Short | 25% | 7% | 0.18 | |

customer retention in retail | 30 | Low | Short | 20% | 7% | 0.42 | |

local retail SEO | 10 | Low | Short | 25% | 7% | 0.18 | |

tools for managing local store inventory | 0 | Low | Short | 0% | 0% | 0 | |

drive traffic to store | 30 | Low | Short | 20% | 7% | 0.42 | |

social media for local business | 90 | Low | Short | 25% | 7% | 1.58 | |

| Competitor Search | Moz Local, Bright Local, Local SEO pricing | 1000 | High | Long | 15% | 5% | 7.5 |

Shopify pricing | 12100 | Low | Short | 10% | 5% | 60.5 | |

Google my business manager | 5400 | Medium | Medium | 15% | 5% | 40.5 | |

| Topic Search | Latest trends in hyperlocal marketing | 0 | Low | Short | 0% | 0% | 0 |

Benefits of omnichannel retail strategies | 320 | High | Long | 10% | 5% | 1.6 | |

AI in hyperlocal marketing | 0 | Low | Short | 0% | 0% | 0 |

The brand search is filled by Sekel therefore haven't considered it for SEO. Below are the pillar pages.

Pillar Pages and subsequent headlines of the articles and broad content description.

Link - https://whimsical.com/increase-foot-F2LsarazF2KS8b2HQfK7FG

Insight: Use case, Competitor and Topic search's SEO wasn't present for Sekel.

Strategy: Creating pillar pages with headlines inside along with content capturing all the search keywords.

Paid Channel 💰

There are multiple ICPs, Retail Marketing Team members, Store Owners, Sales teams, and Digital Marketing Teams. Picking Retail Marketing Team Members as the ICP to run experiments.

For Retail Marketing Team Members as one of the ICPs and based on the above channel prioritization the ICP channel selected is Linkedin as most of them spend time on LinkedIn compared to Google and Meta. , hence will run ads from LinkedIn Campaign Manager.

The CAC to LTV ratio is high as this is going to be low as CPM for running LinkedIn ad is 6000 and the LTV = 1.2CR * 1 year ( minimum )

CAC : LTV = 1 : 2000

Details of the Audience setup

Geo | India |

Company Industry | Retail Motor Vehicles |

Revenue | $100M - $1B |

Job Seniority | Manager |

Age | 24-35 |

Title | Retail Marketing Manager |

Experience | 8 - 12+ |

Below is the campaign manager settings.

Estimated Reach

LinkedIn Campaign Strategy

Link - https://whimsical.com/sekel-QdUhx2RCQ55eZGLVh323qs

Insight: 1 ICP ( Retail Marketing Manager ) spends time on LinkedIn.

Strategy: Running Campaigns based on Region, Channel, TG, Industry, and Sectors helps in Scaling Paid campaign solutions.

Paid Ad Creative 🖌️

Ad creative 1

Ad creative 2

Mockups

Mobile Mockup Web Mockup

Mobile Mockup Web Mockup

Partner Program 🤝

Partner Program 🤝

Partner Program 🤝

Partner Program 🤝Sekel has a partner program and there is a page on the website and how to contact sekel to enroll in the partner program.

Partner program page on the website

The current flow is,

- Digital Marketing Agency needs a solution for its clients (multi-store brands) for hyperlocal discovery solutions.

- Searches online, for example, "Digital Marketing Company for Local Store Management"

- Lands on Sekel's Partner program page

- Fill up a form

- Gets a call from the Sekels Sales team

- Sekel sets up the demo and has a call

- Get into the agreement on the partnership ( Base price set, whatever over and above they pitch is their cut )

- Partner continues to pitch to their clients, if needed involves Sekel in discussions or takes help.

- They wouldn't want the brand directly reaching out to Sekel, but rather be the front face of the Brand.

User feedback from the ICP - DMA ( Digital Marketing Agency ).

- The page doesn't talk to ICP - DMA, but talks to the brand only.

- Only one question in the FAQ section was able to connect to the ICP - DMA

- "Needs a catchy title and Banner"

Framework for Partner Program

- Who will be a partner? ICP?

- Digital marketing, performance marketing, agencies, freelancers who have existing retails clients whom they want pitch. - How will they discover Sekel?

- Seo, and Paid ads for the ICP. - Why & How will they partner?

- WHY - The primary motive is the money, both from the partnership and retention of the client. Secondary is fame.

- HOW - They will share the platform with the client only if the product's perceived value is high = ( Benefits / Cost ) is HIGH - What will they track and how will they track?

- A partner will want to track key KPIs for all their own clients, so they would get access to the dashboard to track major metrics ( discovery metrics, Lead metrics, and Conversions )and configure them to their choice.

- They also track the type of partnership for a particular client, what is the agreement and what is the revenue generated from it. Views, Revenue, Agreement, and Invoices per client flow on thier login ( Partner Admin, Analyst roles ) - How will they be partners and keep getting more clients onboarded?

- Building a strong relationship providing support and assistance so that they can pitch and use the product

- Continuous improvement and communicating the success stories builds high value and helps demonstrate credibility to ICPs clients.

Redesigned Partner Program Page

New Partner Program Page Link

Changes to the page

- Talks to the ICP

- States clear, who, what, how, and why.

- Quick CTA

Below is the further flow of the Partner program.

Insight: The partner program page was not efficient, and the touchpoints did not exist

Strategy: Update the page for ICP, and create a streamlined flow for the partner

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.